Recently, many of our communities have experienced catastrophic disasters and one of the hardest-hit areas is Puerto Rico. Revitalizing disaster areas takes many forms. EVERFI is embarking on an important initiative that will help revitalize Puerto Rico through financial education. We wanted to share this program with you and provide you with information about how your bank can partner with EVERFI to help rebuild an island in need.

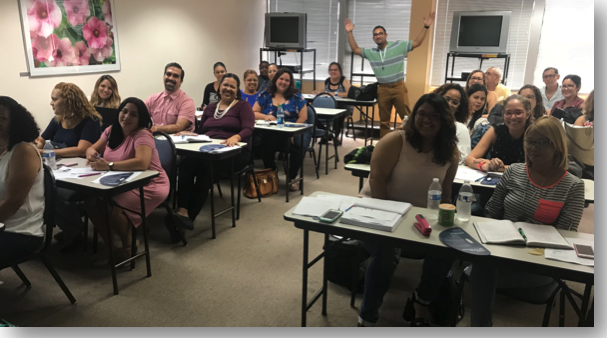

Just days before Hurricane Maria hit the island, EVERFI entered into a strategic partnership with the Puerto Rico Department of Education. EVERFI was endorsed as the Digital Financial Provider for public schools across the island. Even in the way of the humanitarian disaster, schools in and around San Juan displayed amazing resiliency and began to slowly reopen. EVERFI was able to train over 200 teachers, in English and Spanish, three week after disaster struck at no-cost to the Puerto Rico DOE or the local schools.

“I am incredibly proud of the progress that we’ve made in Puerto Rico,” said Ray Martinez, President of Financial Education and Co-Founder of EVERFI, “but there is more work to be done to bring more resources to the island.”

In an August 2017 press release in response to Hurricane Harvey, the OCC, Federal Reserve and FDIC emphasized that “[f]inancial institutions may receive CRA consideration for community development loans, investments, or services that revitalize or stabilize federally designated disaster areas in their assessment areas.” In September 2017, President Trump declared Puerto Rico a disaster area.

The potential for revitalizing and stabilizing Puerto Rico brings the potential for earning CRA credit. A bank does not need to be in Puerto Rico to earn credit for CRA activities. The Federal Reserve has stated it will “give favorable consideration to revitalizing or stabilizing activities in disaster areas by banks located anywhere in the nation” as long as they have demonstrated meeting the needs of their immediate assessment areas. There’s a lot banks can do, and they should look into financial education for their areas, and also for those of Puerto Rico.

Financial education can revitalize disaster-stricken areas, and banks who provide it may, in turn, earn CRA credit. It has been found that education revitalizes both poverty-stricken communities and those struck by disaster. Financial education is even more efficacious because it gives students and adults life skills. According to PolicyLink, when integrated into public programs and the workplace, financial education can help lower-income families improve financial security. Financial security is necessary for economic mobility in poverty-stricken communities, a potential boon for disaster and poverty-stricken areas.

Financial education employed through technology is even better. Martinez believes in the uniting power of education technology when promoted by banks. “If banks work with other industry stakeholders to fuse modern CRA efforts with developing technology, they can spark financial wellness in unprecedented ways.

Wondering How You Can Get Involved?

Revitalizing Puerto Rico is up to all of us. Your bank can support EVERFI’s financial education efforts in Puerto Rico and your own communities today. Let us know you’re interested by emailing us at info@findCRA.com and we’ll be in touch.