“What is low- and moderate-income or LMI?” is one of the most common questions we hear at findCRA. Most people may have a general understanding of what it means to be low-income, but under the federal Community Reinvestment Act, defining low- and moderate-income can seem overly technical and confusing. More importantly, knowing who and what make up low- and moderate-income groups and communities is key to understanding the purpose of CRA and which programs and activities may qualify for CRA support.

We’re going to make it simple to know exactly what it means to be low- or moderate-income, as outlined in the CRA. We’ll discuss both how a person can be low- or moderate-income and also how geographies are LMI.

How do I know if I’m low- or moderate-income?

How do I know if I’m low- or moderate-income?

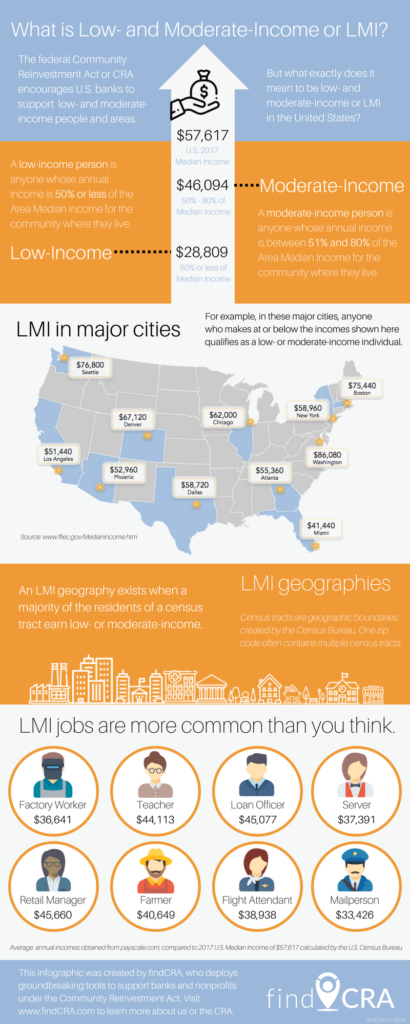

Determining whether you’re a low- or moderate-income person is starts with your annual income or the total amount of money you’re earning each year. Once you know how much you’re earning in a year, you can then compare yourself to the average income earned for people living near you. This average income under CRA is called the Area Median Income or AMI.

If you live in a major metropolitan area, you would compare your income to the AMI for that metropolitan area. Otherwise, you would need to compare your income to the AMI for your state. You can get a current list of the Area Median Incomes, as published by HUD, for each metropolitan area or state at this link.

Once you know your income and the AMI for the area where you live, then you need to determine if you meet the criteria for low- or moderate-income. A low-income person is someone whose total annual income is 50% or less of the AMI or average income for the community where they live. That means if the AMI is $60,000, you need to make less $30,000 a year to be considered low-income.

Using that same guideline, a moderate-income person is someone whose total annual income is above 50% but less than 80% of the AMI or average income for the community where they live. That means, if the AMI is $60,000, you would need to make between $30,001 and $48,000 a year to be considered moderate-income. When you think about the average income for most people, there are more LMI people than you realize.

How do I know if I live in a low- or moderate-income community?

Knowing that a low-income person makes 50% or less than the Average Median Income for an area and a moderate-income person makes between 50% and 80% of the AMI helps us understand how a geography can also become low- or moderate-income.

Geographies can be defined in many ways, including by city borders, county lines and zip codes. Under CRA, the most precise way to look at a geography is by using census tracts. Census tracts are established by the U.S. Census Bureau and often equate to what we may commonly think of as a neighborhood or subdivision. In cities, a single zip code could have several census tracts located in it. That’s because generally, census tracts include between 2,500 and 8,000 people living in them, so the more people living in an area, the more census tracts will likely be there.

A low-income census tract is an area where more than half of the people living in that census tract meet the definition of low-income. So if a census tract has 4,000 people living in it and more than 50% of those people are low-income, than the entire census tract is considered low-income as well.

Similarly, a moderate-income census tract is an area where more than half of the people living in that census tract meet the definition of moderate-income. Again, if a census tract has 4,000 people living in and more than 50% of those people are moderate-income, than the entire census tract is considered moderate-income as well.

Why “low- and moderate-income” matters to CRA?

The Community Reinvestment Act was created to encourage lending and other financial activities in all parts of a community where a bank operates, including LMI people and LMI geographies. A bank cannot choose to only support upper- or middle-income people, if their communities also have low- or moderate-income areas or residents.

When a bank is examined by their federal regulator, they have to show that they are providing loans (and other services, depending on the bank’s asset size) to all income levels in their community. The bank’s regulator looks at the number of people and geographies that are low- and moderate-income, in comparison to the bank’s activity, to determine if the bank is meeting (or at least attempting to meet) the needs of all individuals and geographies in their communities.

Because CRA is an income-focused regulation, it’s important to know how activities support LMI people and geographies when a bank is choosing where to deploy their loans, donations, grants and volunteer resources. By understanding how people and geographies are defined as low- and moderate-income in your community, you can be better prepared to ensure that your programs, services and activities are aligned with CRA requirements.