The American Bankers Association today joined 52 state bankers associations from across the country in sending a joint letter to Congress urging lawmakers to clarify and enforce the statutory prohibition on payment stablecoin issuers and affiliated platforms offering yield, rewards or interest to stablecoin holders — a core provision of the GENIUS Act — because of the potential harm to economic activity.

The letter warns that certain exchanges and other digital platforms are exploiting a loophole to offer yield-like incentives on stablecoins, a practice that “risks disintermediating core banking activity, including deposit taking and lending, which harms local communities.”

“The GENIUS Act envisioned payment stablecoins as a payments instrument, not an investment product. Congress barred issuers from paying interest for precisely that reason,” the letter states. “Closing the current loophole by clarifying that the prohibition extends to partners and affiliates would restore parity, protect consumers, and align practice with legislative intent.”

The associations emphasize that banks operate under strict regulatory frameworks, using deposits to fund lending that supports economic growth. Exchanges, by contrast, “do not perform similar regulated lending activity” and often fund rewards through marketing arrangements or high-risk strategies such as rehypothecation and speculative investments.

“Reducing deposits at banks will impair banks’ ability to make loans,” the groups write. “Requiring banks to increase deposit rates to compete with those offered by exchanges will make credit more expensive, directly affecting the economy — including for small businesses, farmers, homebuyers, students, and local governments.”

In the letter, the groups explain the significant consequences of exchanges taking advantage of the interest loophole and the overall mismatch in regulation:

- Regulatory imbalance. Banks must compete with unregulated platforms offering higher returns resulting from far riskier activities.

- Disintermediation of insured deposits. Consumers may move funds from FDIC-insured deposit accounts into payment stablecoins via exchange-offered products that only sound like interest-bearing accounts but lack equivalent protections. Banks, especially community banks, depend on stable deposits to maintain safety and soundness. When deposits leave the banking system, banks have fewer resources available to lend to small businesses, agriculture, homebuyers and families within their trade area. Exchanges do not recycle funds back into the local economy, banks do. In short, deposit flight into exchange-based products threatens the availability of credit in rural communities and undermines the core economic role banks play across the country.

- Consumer risk and potential loss. When an exchange fails, customers are unsecured creditors with no federal safety net – a reality seen in multiple recent collapses.

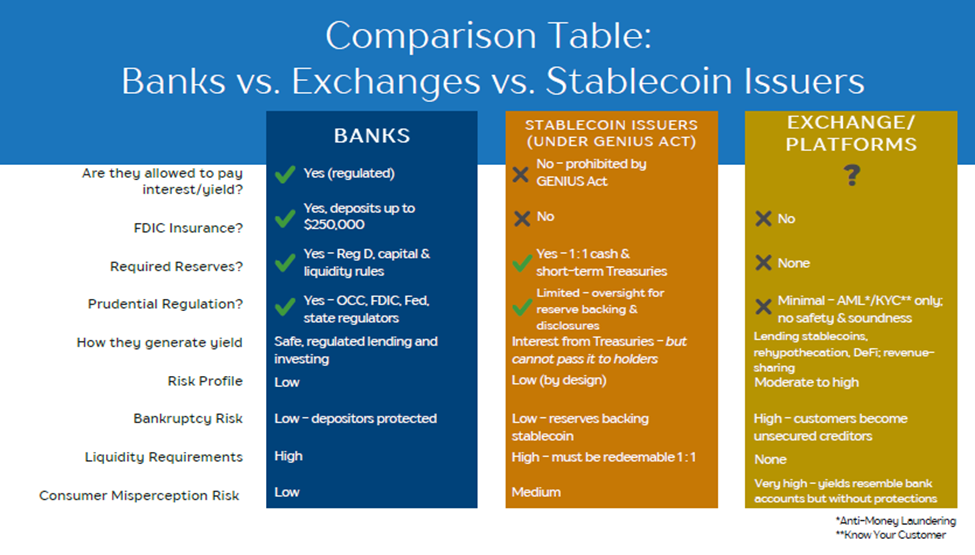

The letter also includes the following graphic that provides a snapshot of key similarities and differences between banks, issuers and exchanges:

The full letter is available here.

Background:

Below is a selection of some of ABA’s recent advocacy efforts on stablecoin.

- ABA Grassroots Action Alert

- Joint Trades Letter to the Treasury’s ANPRM on the GENIUS Act Implementation November 4, 2025

- Joint ABA and State Bankers Associations Letter to the Treasury’s ANPRM on the GENIUS Act ImplementationNovember 4, 2025

- Podcast: The real difference between stablecoins and tokenized deposits September 25, 2025

- Joint Trades Letter to the Senate Banking Committee Urging the Repeal of Section 16(d) of the GENIUS Act August 13, 2025

- Joint ABA and State Bankers Associations Letter Regarding Market Structure Recommendations August 12, 2025

- Letter to House Members re: GENIUS Act, Stablecoin Legislation July 17, 2025

- How stablecoins could affect borrowing costs for the government, businesses and households July 14, 2025

- Statement for the Record before the House Financial Services Committee and House Agriculture Committee on H.R. 3633, the Digital Asset Market Clarity (CLARITY) Act of 2025 June 10, 2025

- American Banker’s BankThink: ABA’s Ybarra: We need stablecoin regulation that doesn’t disadvantage banks May 29, 2025

- Did you know payment stablecoins have similar run risks as money market funds? May 27, 2025