Author: Andrew Dumont1

Since early-April 2020, the Community Development function of the Federal Reserve Board and the twelve Federal Reserve Banks have, approximately every eight weeks, surveyed key stakeholders in local communities across the United States to learn about how the COVID-19 pandemic is affecting their community. Survey respondents have included representatives from local, state and federal governments, financial institutions, nonprofit organizations, and private businesses. This FEDS Note explores the key findings from these four surveys, including differences across type of respondent (government, financial institution, nonprofit, and private business) and type of community served (i.e. rural, suburban, and urban).

Background on the Federal Reserve System’s COVID-19 Community Impact Survey

The spread of the coronavirus (COVID-19) and the many efforts to slow it are affecting communities across the United States. In order for local, state, and national policymakers, practitioners, and others to best respond to the crisis, information is needed about the scope and scale of challenges in various communities. To address this need for timely information on the effects of the crisis, the Community Development function at the Federal Reserve Board and the twelve Federal Reserve Banks have four times fielded the COVID-19 Community Impact Survey (CIS): between April 8-10, June 3-12, August 5-12, and October 7-16. The Federal Reserve System issued a national report summarizing the key findings from each of the survey rounds, which are available on the website of the Federal Reserve Bank of Atlanta.2

The CIS is based on a convenience sampling method that relies on contact databases to identify representatives of nonprofit organizations, financial institutions, government agencies, private businesses, and other community organizations. These representatives were invited by email to participate in an online survey. Because the surveys rely on a convenience sampling method, the individuals who receive it and respond to it will vary. Additionally, the survey responses are not weighted based on any national distribution of organizations. Therefore, each survey provides an insightful and informative “snapshot” into how COVID-19 was affecting the people, organizations, and communities that responded on the dates the survey was administered. Due to differences in the composition and number of respondents between the four surveys, readers should use caution when interpreting the comparisons below between the findings from the four surveys.

Table 1. Number of survey respondents

| Survey period | Number of respondents |

|---|---|

| April 8-10 | 3,897 |

| June 3-12 | 1,869 |

| August 5-12 | 1,464 |

| October 7-16 | 1,127 |

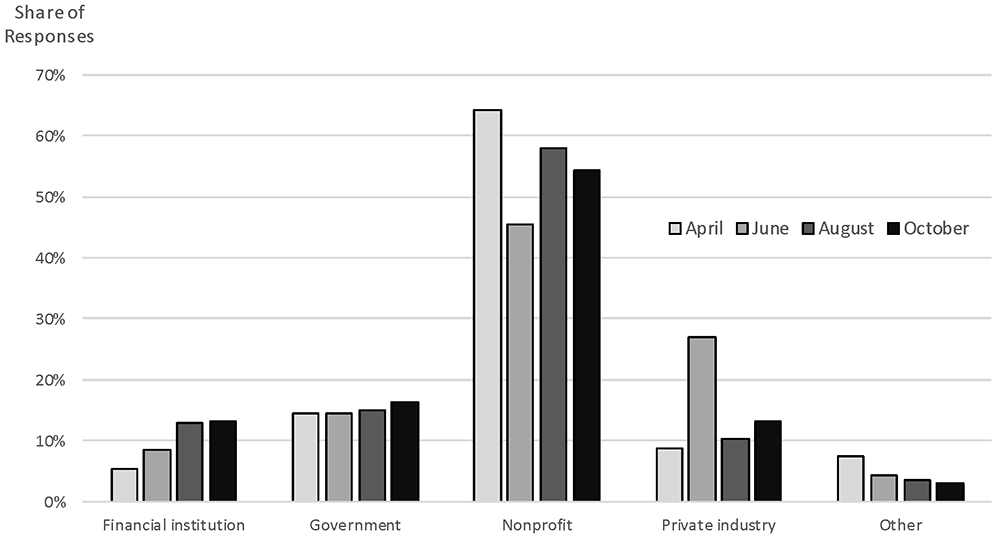

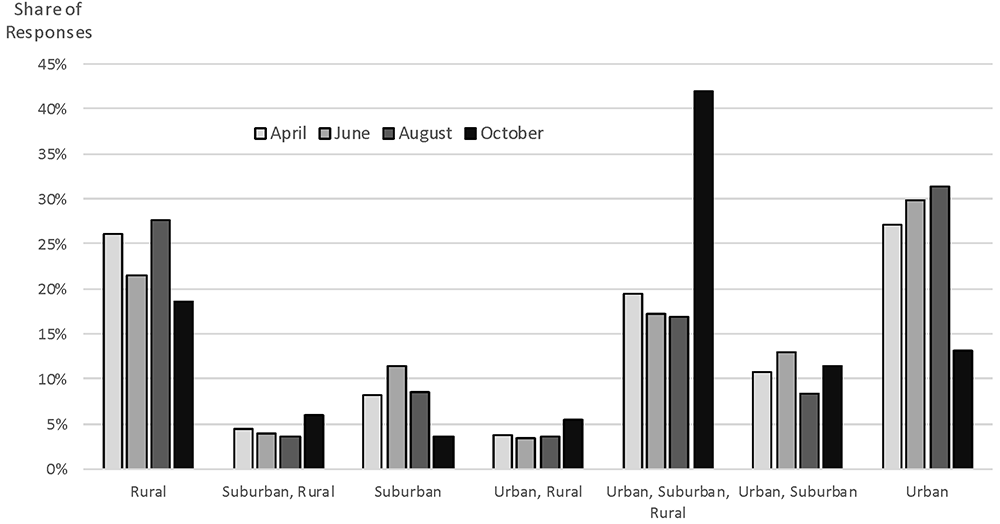

Indeed, as shown in Figure 1 and Figure 2, there were substantial differences in the composition of respondents from survey to survey both in terms of the type of respondents and the types of communities served by those respondents. In particular, the October survey round was an outlier with respect to the types of communities served by survey respondents, with a much higher share of respondents serving all community types, and a much lower share serving just rural, suburban, or urban communities. This may indicate that a greater share of October respondents were larger, more regional organizations than was the case in earlier survey rounds.

Figure 1. Share of respondents by entity type

Nonprofits consistently the largest share of respondents

Note: Key identifies bars in order from left to right.Accessible version

Figure 2. Share of respondents by type of communities served

Distribution of communities served in October substantially different than other surveys

Note: Key identifies bars in order from left to right.Accessible version

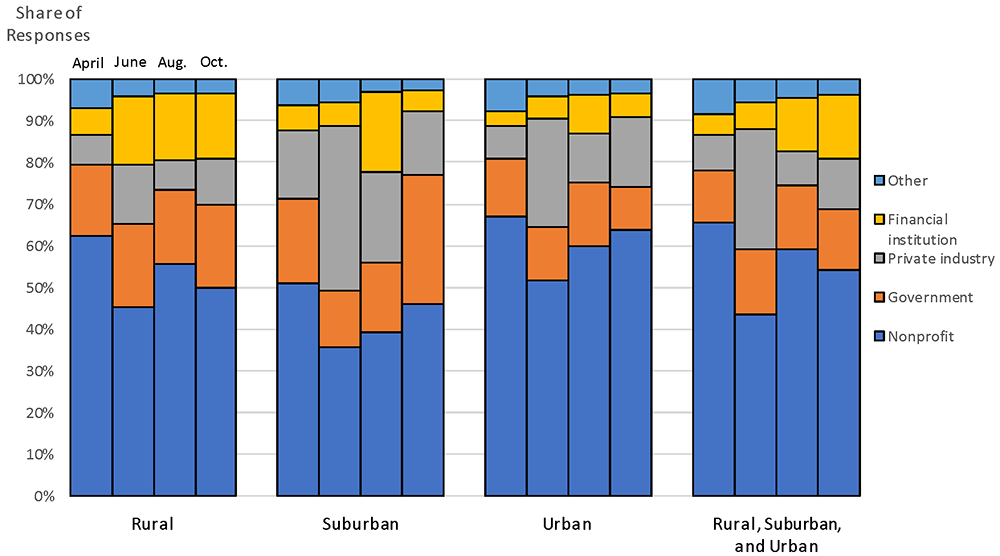

Looking across both entity type and type of communities served, we see a couple of things worth noting (see Figure 3). First, the types of respondents have differed across survey periods within particular types of communities served. For example, the share of respondents serving rural communities that are from nonprofits fluctuated between a high of 62% in April to a low of 45% in June. These fluctuations were not always uniform across types of communities served. In particular, as can be seen above in Figure 1, private businesses represented a much larger share of respondents in the June survey. However, that increase was much less pronounced for those serving rural communities than it was for those serving other community types.

The second finding worth noting is that there have been persistent differences across surveys in the type of entity responding based on the types of communities served. For example, over all four survey periods, a larger share of respondents primarily serving suburban communities have been from private businesses than has been the case for respondents primarily serving other community types, with the exception of urban-serving respondents in October. However, even for suburban-serving respondents, that share has fluctuated widely from survey-to-survey, from a low of 15% for the October survey to a high of 40% for the June survey.

One thing has been largely consistent across all surveys and types of communities served: nonprofits represent the plurality of respondents over almost all survey periods and types of community served.

Figure 3. Respondent entity type by type of communities served

Respondent entity type by type of community served over the four surveys

Note: Colors in key correspond with each bar segment, in order from top to bottom.Accessible version

The reason that these fluctuations in the type of survey respondent matter is that the reported effects of COVID-19 on community-wide and organization-specific conditions differ depending on the type of entity the respondent represents, and the type of communities served by that organization, as I will explore below.

Effects of the COVID-19 Pandemic on Community Conditions

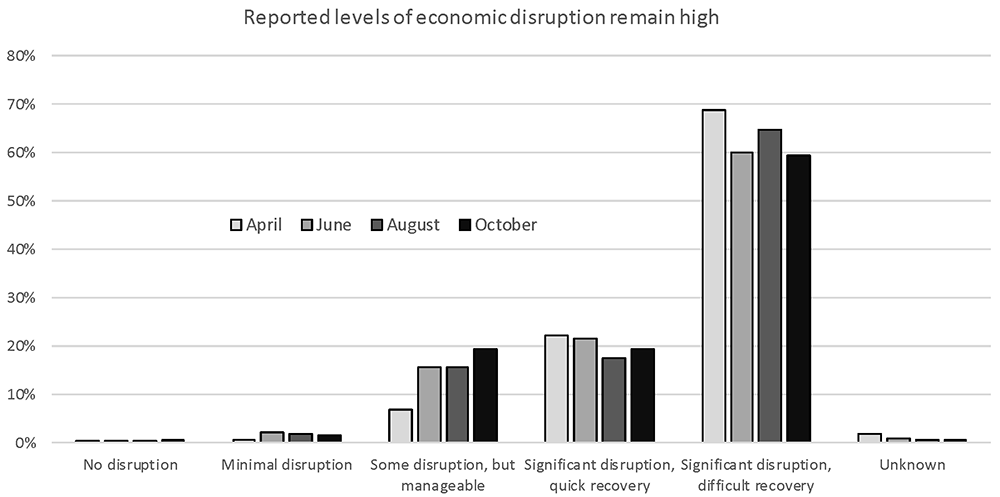

In each of the four surveys, over three-quarters of respondents have reported that the pandemic was having a significant effect on economic conditions in the communities they serve at the time of the survey. This has declined from 91 percent reporting significant disruption in the April survey to 79 percent in the October survey (see Figure 4).

Figure 4. Reported level of economic disruption to the communities served by respondents

Reported levels of economic disruption remain high

Note: Key identifies bars in order from left to right.Accessible version

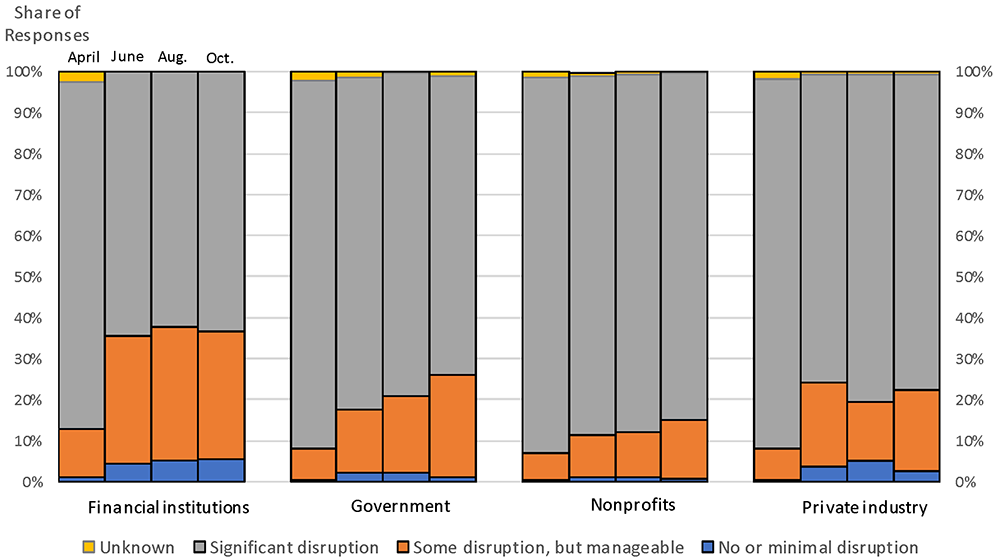

However, the share of respondents reporting significant levels of disruption in their communities differed depending on the type of entity represented by the respondent. In particular, respondents from financial institutions have been much more likely to report that their communities were experiencing some manageable disruption, while nonprofits have been much more likely to report that their communities were experiencing significant disruption (see Figure 5).

Figure 5. Level of economic disruption by type of entity

Nonprofits most likely to report significant disruption, financial institutions least likely

* Note: For the October survey, the differences between the following pairs of entity types were statistically significant at the .05 level using a chi-square test: government vs nonprofits; and financial institutions vs nonprofits.Note: Colors in key correspond with each bar segment, in order from top to bottom.Accessible version

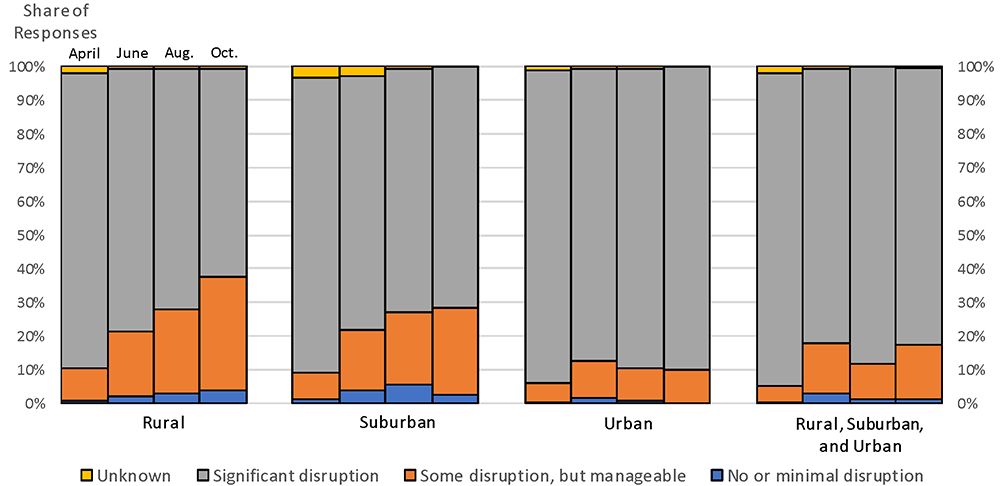

In addition to differences by type of entity, there have been large, and increasing, differences in the reported economic effects depending on the types of communities served by the respondent. Rural-serving respondents have consistently reported less significant disruption from the pandemic than urban-serving respondents (see Figure 6). This does not come as a great surprise, given the difference in employment effects that have been observed in rural versus urban communities.

Figure 6. Level of economic disruption by type of communities served

Urban respondents most likely to report significant effects; rural respondents least likely

* Note: For the October survey, the differences between the following pairs of community types were statistically significant at the .05 level using a chi-square test: suburban vs urban; rural vs rural, suburban, and urban; and rural vs urban.Note: Colors in key correspond with each bar segment, in order from top to bottom.Accessible version

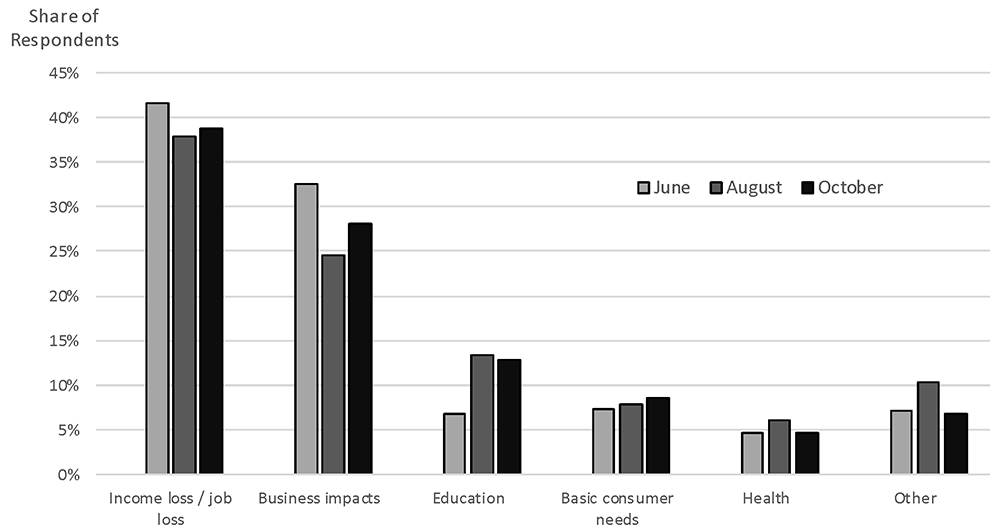

Top Reported Impact on the Community

Starting with the June survey, the Federal Reserve began asking respondents to report what the top impact to their community has been. The plurality of respondents have consistently chosen income loss / job loss / unemployment as the top impact affecting their community, followed by business impacts (including short / long-term closure, supply chain disruption, and reduced demand). See Figure 7.

Figure 7. Top reported impacts to the communities served by respondents

Job losses and business impacts are the top reported impacts

Note: Key identifies bars in order from left to right.Accessible version

However, this again differed depending on the type of communities served by the respondent. Respondents serving rural or suburban communities were more likely to choose business impacts or education as the top impacts in their communities than urban-serving respondents or those respondents serving all community types. This has been particularly true with respect to education, whereby 19 percent and 21 percent of rural respondents selected this as their communities’ top impact in August and October, respectively, versus just 11 percent of urban respondents in both surveys. Twenty percent of suburban respondents selected education as the top impact in their communities in the August survey, but this had declined to just 8 percent in the October survey. It is unclear if this simply represents a change in the type of respondent from suburban areas between these two survey periods, or an actual change in the degree of impact. The differences in the top impacts chosen in October were statistically significant when comparing rural- and urban-serving respondents, suburban- and urban-serving respondents, and rural-serving respondents and those serving all community types.

Perhaps not surprisingly given their different vantage points, the top impacts reported by respondents differed substantially depending on the type of entity they represented. Financial institutions and private businesses were more likely than governments or nonprofits to report business impacts as the top impact to their communities, whereby governments and nonprofits were more likely to report job losses as the top impact. Nonprofits were also much more likely than other respondents to report basic consumer needs (i.e. housing, food, and other personal needs) as a top impact. The differences in the top impacts chosen in October were statistically significant when comparing financial institutions and nonprofits, and nonprofits and private businesses.

Interestingly given that the surveys were administered in the midst of a pandemic, health impacts were considered the top impact by only a small share of respondents, regardless of the type of entity or type of communities served by the respondent. However, this is likely more a reflection of the types of individuals and organizations represented in the Federal Reserve’s contact databases than a reflection on the importance or prominence of the health effects of the pandemic on the communities in question.

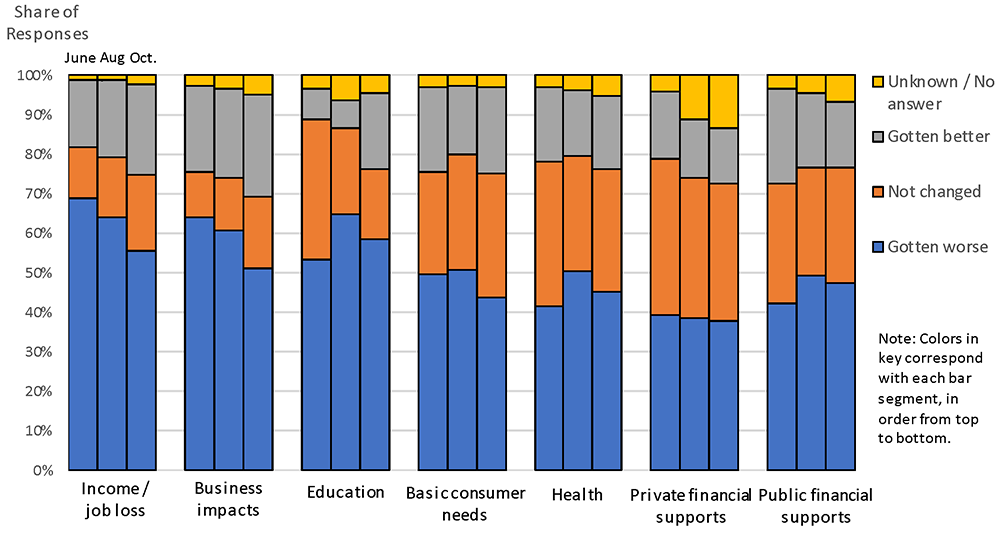

When respondents were asked how conditions pertaining to these top impacts changed over the eight weeks prior to the survey, a majority have consistently reported that conditions related to job losses, business impacts, and education in the communities they serve worsened between April and October. However, a slightly lower share of respondents reported worsening conditions related to job losses, business impacts, and education in the October survey than did in the June survey, with an increasing share reporting improving conditions. Reported changes in community conditions related to basic consumer needs, health, and public and private financial supports have fluctuated inconsistently between the three survey rounds in which these questions were asked (see Figure 8).

Figure 8. Changes in top community impacts between surveys

Over the past eight weeks, community impacts in this area have…

Note: Colors in key correspond witheach bar segment, in order from top to bottom.Accessible version

However, again, these reported changes in community conditions differ substantially depending on the type of communities served by the respondent. Specifically, higher shares of urban-serving respondents consistently report worsening conditions across all impact areas than respondents primarily serving other types of communities (see Table 2).

Table 2. Change in community conditions over the eight weeks prior to the October survey, by type of communities served (percent reporting that conditions have worsened)

| Type of Communities Served | Income loss / job loss | Business impacts | Education | Basic consumer needs | Health | Public support | Private support |

|---|---|---|---|---|---|---|---|

| Rural | 48 | 54 | 60 | 35 | 46 | 35 | 30 |

| Suburban | 46 | 47 | 45 | 34 | 22 | 37 | 29 |

| Urban | 76*^# | 65*# | 64* | 55*^ | 55^ | 63*^ | 48* |

| Rural, Suburban, and Urban | 58 | 50 | 58 | 46 | 45 | 50 | 40 |

* Difference compared to rural-serving respondents is statistically significant at the .05 level

^ Difference compared to suburban-serving respondents is statistically significant at the .05 level

# Difference compared to rural, suburban, and urban-serving respondents is statistically significant at the .05 level

One example where this shows up most starkly is reported conditions related to job losses. Whereas the share of respondents reporting that conditions have gotten worse related to job losses has steadily gone down across the June, August, and October surveys for those serving rural, suburban, or all community types, for those primarily serving urban communities it has remained consistent, with around three quarters of such respondents reporting worsening job losses.

Table 3. Change in community conditions over the eight weeks prior to the October survey, by entity type (percent reporting conditions have worsened)

| Type of entity | Income loss / job loss | Business impacts | Education | Basic consumer needs | Health | Public support | Private support |

|---|---|---|---|---|---|---|---|

| Financial institution | 37 | 46 | 34 | 24 | 49 | 32 | 22 |

| Government | 49 | 39 | 41 | 38 | 48 | 40* | 29* |

| Nonprofit | 61* | 54* | 48* | 51* | 62* | 52* | 41* |

| Private industry | 59* | 59* | 47 | 39* | 63* | 50* | 48* |

* Difference compared to financial institutions is statistically significant at the .05 level

There are also large differences in how respondents report that community conditions have been changing depending on the type of entity they represent (see Table 3). Perhaps most stark is the difference between financial institutions and nonprofits and private industry, whereby a much larger share of nonprofit and private industry respondents report worsening conditions than do financial institutions across all of the impact areas. The incongruity between the changes reported by financial institutions and those reported by nonprofits has been particularly acute and consistent over the three surveys, a fact that may have implications for the effectiveness and extent of financial institutions’ Community Reinvestment Act activities.

Recovery expectations

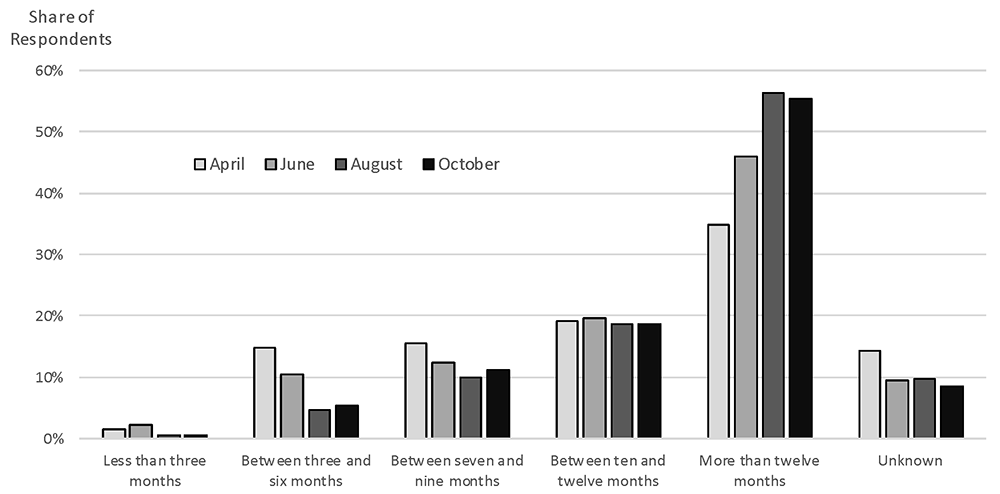

Overall, the majority of survey respondents expect it to take more than twelve months for the communities they serve to return to the conditions they were experiencing before they were affected by the COVID-19 pandemic (see Figure 9). Respondents’ expectations regarding the time to recover have steadily diminished over the four surveys, which is particularly interesting since the question asks respondents to estimate how long they expect the recovery to take starting from today. So, those answering three to six months in April were expecting the recovery to have been complete by sometime between July and October. Therefore, in October, more than half of respondents did not expect their communities to have fully recovered from the effects of the pandemic until sometime after October 2021.

Figure 9. Recovery expectations across survey periods

Expectations for a quick recovery have steadily diminished

Note: Key identifies bars in order from left to right.Accessible version

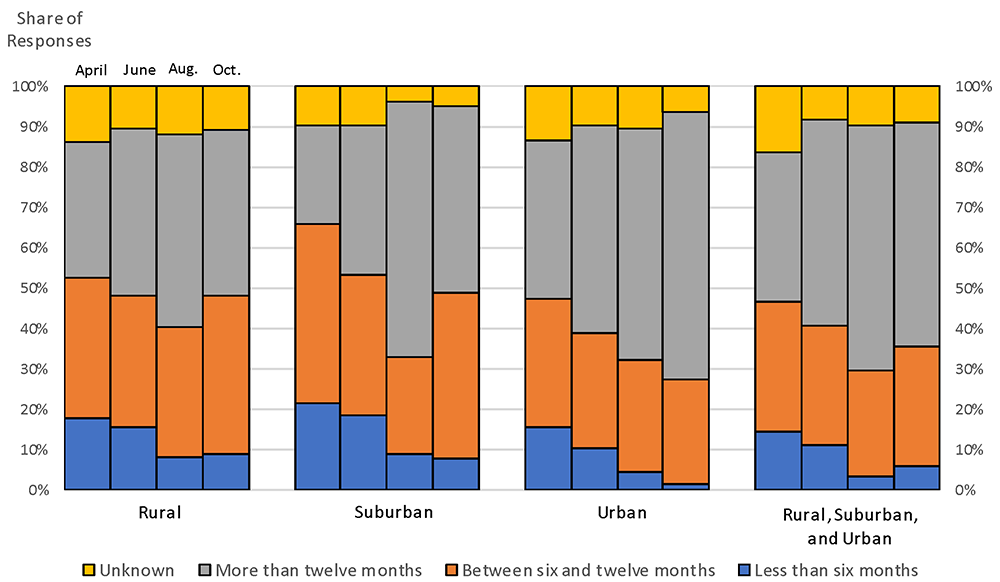

As with the topics explored above, however, there were large reported differences based on the type of respondent, with a larger share of rural and suburban respondents expecting a quicker recovery, and a larger share of urban respondents expecting a longer recovery (see Figure 10).

Figure 10. Recovery expectations by type of communities served

Rural respondents expect quickest recovery, urban respondents expect slowest

* Note: For the October survey, the differences between the following pairs of community types were statistically significant at the .05 level using a chi-square test: rural vs rural, suburban, and urban; and rural vs urban.Note: Colors in key correspond with each bar segment, in order from top to bottom.Accessible version

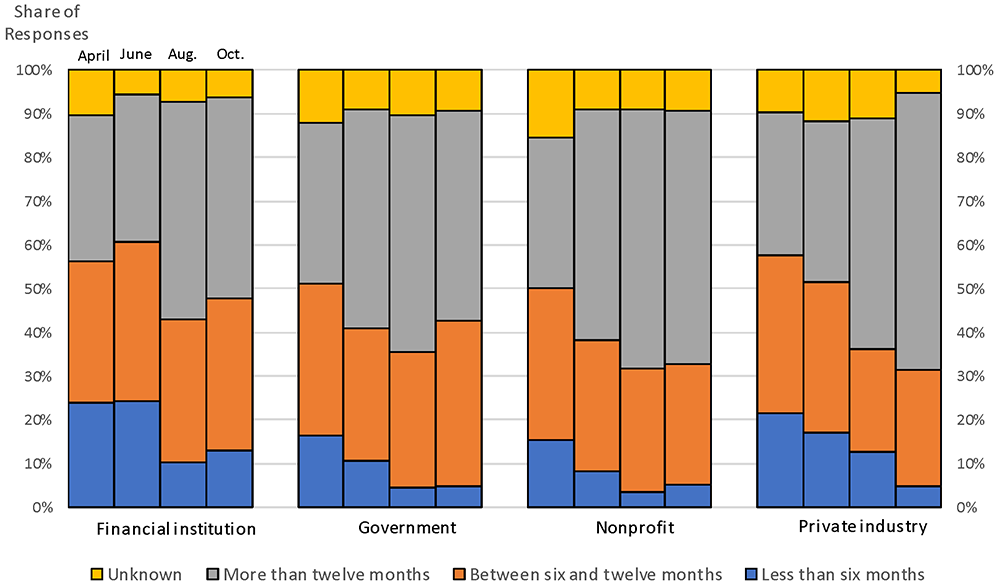

Not surprisingly given the findings described above, financial institutions expected the quickest recovery, while nonprofits and private businesses expected the longest recovery (see Figure 11).

Figure 11. Recovery expectations by type of entity

Financial institutions expect quickest recovery, nonprofits and private businesses expect slowest

* Note: For the October survey, the differences between the following pairs of entity types were statistically significant at the .05 level using a chi-square test: financial institutions vs government; financial institutions vs nonprofits; and financial institutions vs private businesses.Note: Colors in key correspond with each bar segment, in order from top to bottom.Accessible version

Conclusion

This FEDS Note explored key findings from the four Community Impact Surveys fielded by the Federal Reserve’s Community Development function, including differences across type of respondent and type of community served. It found that the composition of respondents has changed from survey to survey, which is expected given the use of a convenience sampling method for recruiting survey respondents.

While we cannot discern whether the changes seen across surveys are the result of changes in the composition of respondents or actual changes in conditions on the ground, several key findings stand out. First, a large majority of respondents report that the pandemic has had a significant effect on the communities they serve. Second, respondents consistently report that job losses and business impacts represent the top impacts of the pandemic on the communities they serve, ahead of other important effects like those to education and health. Third, a large share of respondents report that conditions in the communities they serve continue to worsen. Lastly, recovery expectations have steadily diminished over the course of the pandemic.

In addition, this analysis found that there are meaningful differences in reported conditions depending on the type of communities served by the respondent, and what type of entity they represent. Due to these important differences, policymakers, funders, and others looking to support community needs who are hoping to understand how the pandemic is affecting communities across the country, and how to respond, must seek out perspectives from different types of organizations and in different communities. Anyone engaging with representatives from just one type of entity or from one type of community are likely to have a distorted view of conditions on-the-ground across the country.

1. The analysis and conclusions set forth are those of the author and do not indicate concurrence by other members of the staff or the Board of Governors of the Federal Reserve System. Return to text

2. The national summary reports are available at: https://www.frbatlanta.org/community-development/publications/national-covid-19-survey Return to textPlease cite this note as:

Dumont, Andrew (2021). “The Effects of COVID-19, as Reported by Local Communities,” FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 12, 2021, https://doi.org/10.17016/2380-7172.2844.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.