The growing use of smartphones and the Internet has brought rapid change to financial services. These new technologies have given consumers and banks new tools for managing money and changed the customer-bank relationship. They have also raised new concerns about security and access. Mobile banking may help to address some challenges consumers face, like the decline in physical bank branch locations or the need for timely access to account payment and balance information. However, a well-designed and secure mobile platform, as well as consumer access to and facility with mobile technology and the Internet, are likely needed in order for mobile banking to be a reliable banking channel.

This note presents new estimates of mobile banking use in 2017, as well as insights on types of users and their behaviors. This “under-the-hood” look at estimates of mobile banking use can inform discussions about consumer access to banking services and tools for account management. Careful measurement is the first step in understanding how a broad spectrum of consumers could tap the potential of mobile financial services while addressing possible concerns about technology.

Trends in mobile banking use

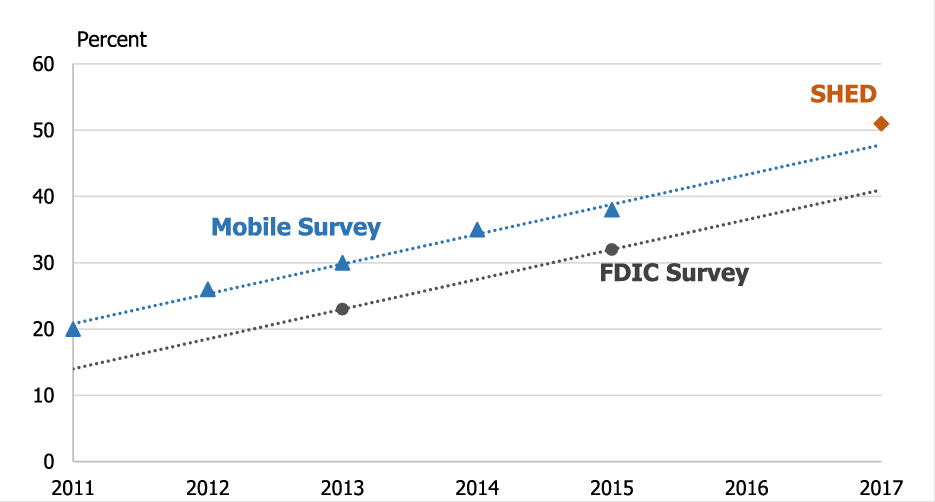

While mobile phones have been prevalent in the U.S. for the past decade, smartphone adoption has grown rapidly in recent years.2 The uses for smartphone technology have expanded, including the use of mobile phones for banking. In 2017, about half of U.S. adults with bank accounts had used a mobile phone to access a bank account in the past year. This latest estimate is from the Federal Reserve Board’s Survey of Household Economics and Decisionmaking (SHED).3 As shown in Figure 1, mobile banking use has risen steadily in recent years, based on earlier estimates from the FDIC National Survey of Unbanked and Underbanked Households (FDIC Survey) and the FRB’s Survey of Consumers’ Use of Mobile Financial Services (Mobile Survey).4

Note: SHED and Mobile Survey estimates are percent of U.S. adults with a bank account. FDIC Survey estimates are percent of U.S. households with a bank account who accessed their account in the past 12 months. Dashed lines are estimated linear trends.

Source: Survey of Household Economics and Decisionmaking (SHED), Survey of Consumers’ Use of Mobile Financial Services (Mobile Survey), FDIC Survey of Unbanked and Underbanked Households (FDIC Survey).

The estimate of mobile banking in 2017 is not fully comparable to estimates from earlier years, due to differences in the three surveys. The wording for the 2017 SHED question on mobile banking is very similar to the question from the FDIC Surveys in 2015 and 2013.5 However, the SHED (and the Mobile Surveys) are online surveys, whereas the FDIC Survey is conducted by telephone and in person. Individuals who complete an online survey may also have greater comfort with the Internet and mobile technology than the overall adult population. Thus, the differences in survey mode could contribute to the higher estimates of mobile banking in the SHED and Mobile Survey than in the FDIC Survey.6

Taken together, these three surveys show an upward trend in mobile banking since 2011. This trend is consistent with the increase in smartphone adoption over this period and the rising share of banks offering mobile banking services to their customers.7

Using a mobile phone for banking can encompass a number of different tasks, and how consumers conceptualize “mobile banking” may vary. The 2017 SHED asked consumers about mobile banking use in two different ways. The first question asked about all the ways a consumer had accessed a bank account in the past year, including general mobile banking use as one option. This was followed by a more specific question asking whether they had used a mobile phone to check a bank account balance or recent transaction in the past year.8 Of those with a bank account, a larger share (61 percent) said they had used their mobile phone to do this specific task than said yes to the first, more general question about using a mobile phone to access a bank account (51 percent).

So how should we interpret these different answers? And which is a more accurate measure of mobile banking use? In interpreting such data, we need to understand the types of mobile banking tasks and users included in these survey measures.

A closer look at mobile banking use from the 2015 Mobile Survey

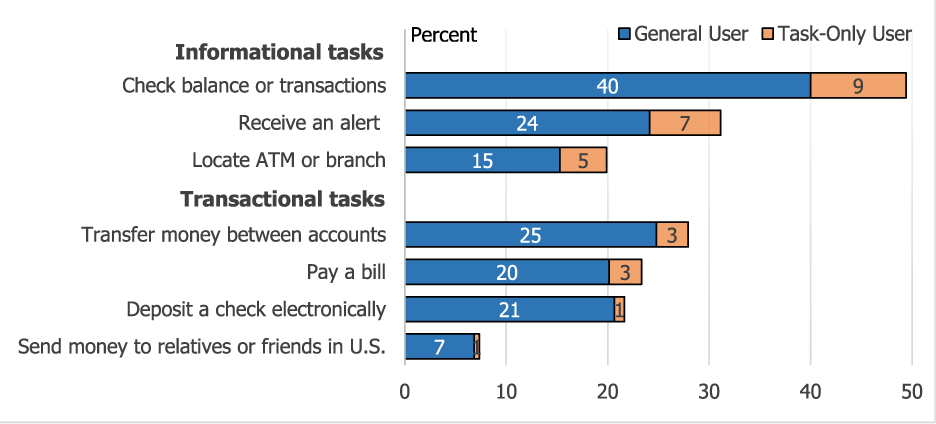

The different survey responses on general mobile banking use versus a specific mobile banking task, seen in the 2017 SHED, also occurred in the 2015 Mobile Survey. The Mobile Survey included more questions on mobile banking tasks than the SHED and allows us a closer look at the reasons for this pattern.9 Figure 2 suggests that surveys using a general question about mobile banking use to screen for subsequent questions on specific mobile banking tasks would underestimate the use of some tasks. For example, about half of those with a bank account and mobile phone said they had used a mobile phone to check an account balance or recent transactions. But had this question about tasks only been asked to those who reported general use of mobile banking, the estimate of people checking their account balances with a mobile phone would have been 9 percentage points lower. To reduce survey costs and respondent burden, the response to a general question is often used to determine who is asked more specific, follow-up questions. 10 But if the general concept behind the screener question is complicated or not well understood, respondents may not answer it in the way it was intended. For the purposes of this note, the term “task-only user” refers to consumers who reported doing one or more mobile banking tasks, but, unlike the “general user” group, answered “no” to the question about general mobile banking use.

Screening on general mobile banking use would miss many individuals who engage in informational tasks, like checking an account balance, receiving an alert, or locating a branch. In contrast, using a screener question would have less effect on estimates of use for transactional tasks, including transferring money between accounts, paying a bill, depositing a check, or sending money to friends or family.

Note: Percent of U.S. adults with a bank account and a mobile phone.

Source: 2015 Mobile Survey.

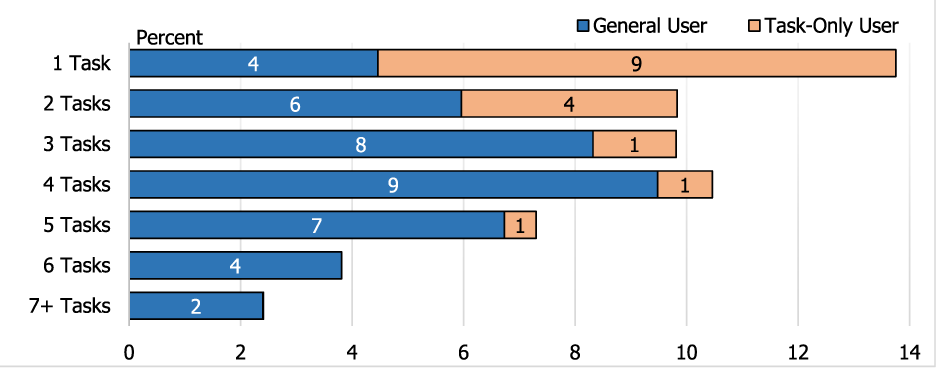

The number of different mobile banking tasks a person engages in may also help to explain a difference between their responses about general use and specific tasks. As shown in Figure 3, the general use question largely misses mobile banking users who only do one or two tasks. In contrast, almost all of the individuals who report three or more mobile banking tasks also said that they use mobile banking in the general question.11 This raises an interesting issue of whether we want to consider one-task users to be mobile banking users or if multiple-task users are closer to actual users of the technology.

Note: Percent of U.S. adults with a bank account and a mobile phone.

Source: 2015 Mobile Survey.

Several factors, some related to survey techniques and others related to the real-world complexity of this new technology, could contribute these differences in reporting. The wording of the general definition of mobile banking – “…access your bank or credit union account” – could be interpreted as implying transactional tasks, and not the receipt of information about an account or a bank location. Respondents often ignore larger blocks of text (like the definition of mobile banking) and may rely more on their own conception of what “mobile banking” would include, which could be transactional tasks. In addition, research on survey methods has found that asking about use through a checklist or sequence of individual questions gives higher estimates of use that asking about use in general. Individual questions or examples can improve recall, particularly for heterogeneous or complex activities.12

Differences between consumers in their adoption of and comfort with technology (smartphones, apps, etc.) help to explain differences in task usage. The way in which tasks are done could also affect whether consumers think of these activities as “mobile banking.” While some of the informational tasks (e.g., receiving alerts, checking a balance) can be done with a feature phone via text message or on a web browser on a smartphone, transactional tasks may require the use of the bank’s app. As shown in Table 1, relative to general mobile banking users, task-only users are somewhat less likely to have a smartphone and they are much less likely to have their bank’s mobile banking app. On average, they are also less confident in understanding and using the features of their mobile phone.

Table 1: Adoption of and Confidence with Mobile Phone Technology

| General User | Task-Only User | |

|---|---|---|

| Have smartphone | 97 | 81 |

| Have bank’s mobile banking app | 82 | 19 |

| Very confident with technology and features of mobile phone | 74 | 50 |

Note: Among U.S. adults with a bank account and mobile phone, percent of each group (general user or task-only user).

Source: 2015 Mobile Survey.

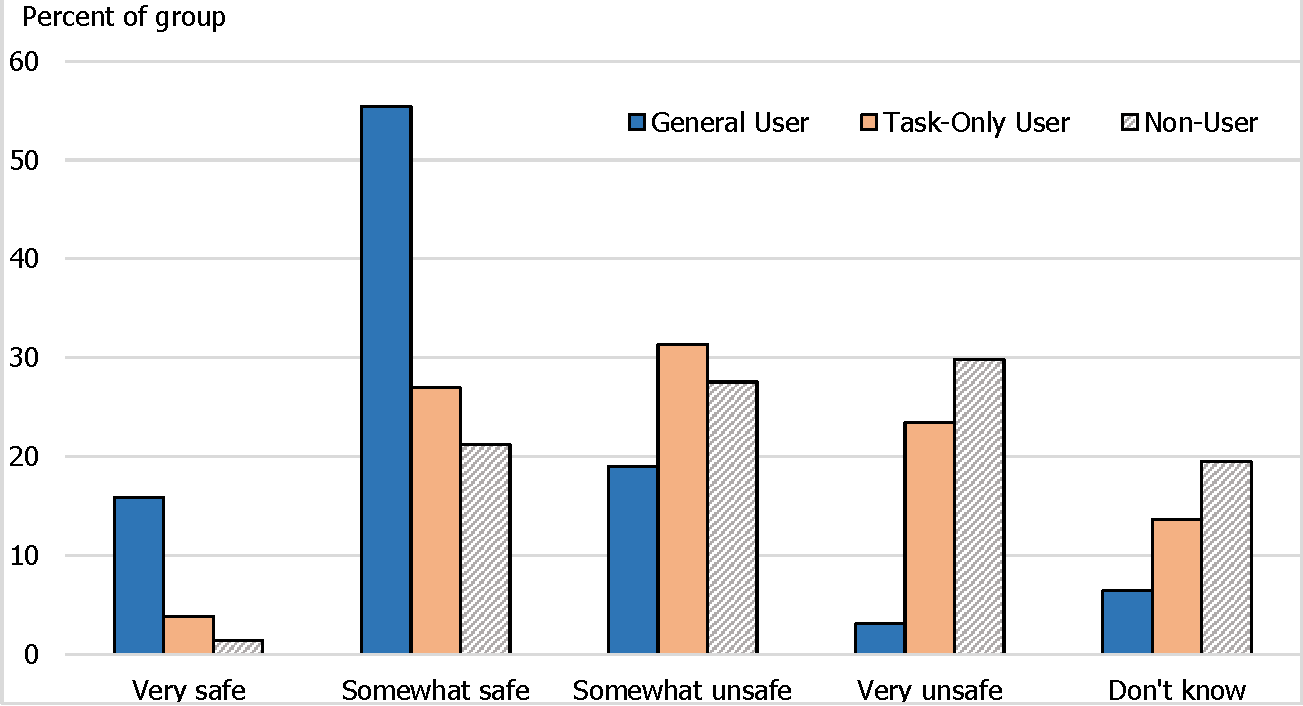

Concerns about the security of personal information also help to explain differences in the adoption of mobile banking. When asked about the safety of personal information when using mobile banking, the majority (71 percent) of those who reported general mobile banking use said that personal information was very safe or somewhat safe when using mobile banking (Figure 4). In contrast, the majority of task-only users reported it was very unsafe or somewhat unsafe (54 percent) or said they did not know (14 percent). Those with mobile phones and bank accounts who did not indicate they had used mobile banking in any of the questions (general use or specific tasks) had less trust in the security of mobile banking than the task-only users.

Note: Among U.S. adults with a bank account and mobile phone, percent of each group (general user, task-only user, or not a mobile banking user).

Source: 2015 Mobile Survey.

Other research has shed light on the relationship between risk perceptions and mobile banking adoption. Cope, Rock, and Schmeiser (2013) highlight findings from the literature on technology adoption indicating that early adopters of technology are more willing to take risks. Using data from the 2011 Mobile Survey, they find that the adoption of mobile banking is affected by consumer perceptions of the safety of mobile banking as well as personal tolerance for risk in general.13Through a survey and interviews on the use of mobile financial services in New York City, the New York City Department of Consumer Affairs (2015) found that respondents had a strong preference for low-risk, passive receipt of account information using their phone (e.g., alerts). This suggests that limiting mobile banking use to informational tasks could be a consumer response to perceived differences in the risks associated with different mobile banking tasks. The NYC study also found that the unbanked were more likely to share a phone with other people than the underbanked or fully banked – a reminder that some consumers may face many practical challenges in securing a phone or app from unauthorized access.14

Discussion

So is there a better way to measure mobile banking use?

If the use of individual mobile banking tasks is of interest, then we get more inclusive measures by asking directly about those tasks and not screening on a general use question. This is particularly true for informational tasks like receiving alerts and checking the balance of an account. These tasks may be basic, but they are important tools that consumers may rely on to monitor their accounts.15

If we are interested in identifying consumers who use a range of mobile banking features, then a general question about use seems to be a good starting point. In the 2015 Mobile Survey, general mobile banking users were much more likely to say that the mobile channel is one of the three most important ways they interact with their bank (53 percent) than task-only users (8 percent). Alternatively, asking directly about tasks but focusing on users who have their bank’s app and are doing several tasks would be another way to identify consumers who are more fully engaged with the mobile channel as a way they bank.

More broadly, technology adoption is a continuum, so analysts should be mindful of this as they use measures that group people into “adopters” or “non-adopters.” Underlying any measure of technology use we will find variation across consumers in their comfort with technology and their preferences or constraints. While mobile banking use is clearly rising, many consumers still want or need the services of other channels, like branches and ATMs. Indeed, among general mobile banking users in the 2015 Mobile Survey, 51 percent listed branch and 62 percent listed ATM among the three most important ways they interact with their bank.

The decision not to use mobile banking, or to limit use, may be the best choice for some consumers, given their preferences and comfort with technology. Others who are hesitant to adopt new technology may begin to use it in time, but this may require some encouragement and assistance, and learning by doing.16 Even for those who would do all of their banking on their phone if they could, there are still limitations to what technology can accomplish. You can start an ATM transaction on a mobile phone, but getting the cash still requires a visit to the ATM in real life.

Appendix: Survey Questions on Mobile Banking Use

2017 Survey of Household Economics and Decisionmaking (SHED)

A report and data for the 2017 SHED are forthcoming later this spring and will be available with the prior years’ (2013-2016) SHED results at https://www.federalreserve.gov/consumerscommunities/shed.htm.

General mobile banking use

[Asked of respondents with a bank account]

In the past 12 months, have you or your spouse/partner accessed an account in each of the following ways?

| Yes | No | |

|---|---|---|

| Bank teller | ||

| ATM or bank kiosk | ||

| Telephone banking through phone call or automated voice or touch tone | ||

| Online banking with a laptop, desktop computer, or tablet | ||

| Mobile banking with text messaging, mobile app, or Internet browser or email on a mobile phone | ||

| Other |

Mobile banking task

[Asked of respondents with a bank account]

In the past 12 months, have you or your spouse/partner used your mobile phone to check a bank account balance or recent transaction, either through the bank’s mobile website or the bank’s mobile app?

□ Yes

□ No

2015 Survey of Consumers’ Use of Mobile Financial Services (Mobile Survey)

The reports and data from all five years (2011-2015) of the Mobile Survey are available at https://www.federalreserve.gov/consumerscommunities/mobile_finance.htm.

General mobile banking use

[Asked of respondents with a bank account and mobile phone]

Mobile banking uses a mobile phone to access your bank or credit union account. This can be done either by accessing your bank or credit union’s web page through the web browser on your mobile phone, via text messaging, or by using an app downloaded to your mobile phone.

Does your bank or credit union offer mobile banking?

□ Yes

□ No

□ Don’t know

Have you used mobile banking in the past 12 months?

□ Yes

□ No

Mobile banking tasks

[Asked of respondents with a bank account and mobile phone]

Using your mobile phone, have you done each of the following in the past 12 months?

| Yes | No | |

|---|---|---|

| Checked an account balance or checked recent transactions | ||

| Made a bill payment using your bank’s online banking website or banking app | ||

| Received an alert (e.g., a text message, push notification or email) from your bank | ||

| Transferred money between your bank accounts | ||

| Sent money to relatives or friends within the U.S. using your bank’s app or mobile website | ||

| Sent money to relatives or friends outside the U.S. using your bank’s app or mobile website | ||

| Deposited a check to your account electronically using your mobile phone camera | ||

| Located the closest in-network ATM or branch for your bank |

1. The author thanks Alejandra Lopez-Fernandini and Claudia Sahm for helpful comments and suggestions. The views expressed in this note are those of the author and do not necessarily reflect those of the Federal Reserve System. Return to text

2. The Pew Research Center estimates that around 80 percent of U.S. adults had a mobile phone in 2008, rising to over 90 percent in 2016. The share of U.S. adults who own a smartphone rose from 35 percent in 2011 to 77 percent in 2016. See https://www.pewinternet.org/fact-sheet/mobile/. Return to text

3. This note uses pre-release data from the 2017 SHED, which was fielded as an online survey in November and December of 2017. Data are weighted to yield estimates for the U.S. adult population ages 18 and over. The full 2017 SHED report and data will be available later this spring at https://www.federalreserve.gov/consumerscommunities/shed.htm. Return to text

4. Reports and data for the FDIC Survey are available at https://www.economicinclusion.gov/. Reports and data for the Mobile Survey are available at https://www.federalreserve.gov/consumerscommunities/mobile_finance.htm. Return to text

5. The FDIC also repeated their survey in 2017. Their results are forthcoming and will be available at https://www.economicinclusion.gov/. The survey questions are available at https://www.fdic.gov/regulations/laws/federal/2017/2017_household-survey-questionnaire-02-01-2017.pdf. . Return to text

6. For example, the Pew Research Center (2015) notes that the survey mode can affect survey participation and the context in which people respond to questions, and particular challenges can arise when the survey mode is related to the topic of the survey. They find that measures of some aspects of technology use are higher among web respondents than for telephone respondents. See Pew Research Center (2015) From the Telephone to the Web: The Challenge of Mode of Interview Effects in Public Opinion Polls, https://assets.pewresearch.org/wp-content/uploads/sites/12/2015/05/2015-05-13_mode-study_REPORT.pdf. Return to text

7. In the 2012-2015 Mobile Surveys, convenience, getting a smartphone, and their bank beginning to offer mobile banking were the top reasons consumers gave for when they began using mobile banking. For a summary of several surveys of financial institutions about their offering mobile banking, see Marianne Crowe, Elisa Tavilla, and Breffni McGuire (2017) Mobile Banking and Payment Practices of U.S. Financial Institutions: 2016 Mobile Financial Services Survey Results from FIs in Seven Federal Reserve Districts https://www.bostonfed.org/publications/mobile-banking-and-payment-surveys/mobile-banking-and-payment-practices-of-us-financial-institutions.aspx. Return to text

8. The 2017 SHED general use and task questions for mobile banking are included in an Appendix to this note. Return to text

9. The 2015 Mobile Survey general use and tasks questions for mobile banking are included in an Appendix to this note. Return to text

10. In the 2011-2013 Mobile Surveys, only those respondents who answered “yes” to the general mobile banking question were asked a follow up question about tasks. In the 2014 and 2015 Mobile Surveys, all respondents with a bank account and mobile phone were asked both the general use and specific task questions, but task usage in the published report was conditioned on saying “yes” to the general use question to be consistent with the earlier years of the report. Return to text

11. There is also a connection between type and number of tasks. Almost all of the one-task and two-task users who just receive alerts or locate a branch do not report general use. However, almost all of the one-task users who use a mobile phone to deposit a check electronically do report general mobile banking use. Return to text

12. For a discussion of the use of a checklist in measuring complex activities, see Nora Cate Schaeffer and Stanley Presser (2003) The Science of Asking Questions, Annual Review of Sociology 29:65–88. https://www.annualreviews.org/doi/full/10.1146/annurev.soc.29.110702.110112. In a recent application of this approach to measuring use of a financial product, Hitczenko and Tai (2014) find that a sequence of “disaggregated” questions yields higher and more accurate measures prepaid card use than a general question. See Marcin Hitczenko and Mingzhu Tai (2014) Measuring Unfamiliar Economic Concepts: The Case of Prepaid Card Adoption, Federal Reserve Bank of Boston, Research Department Working Papers No. 14-9 https://www.bostonfed.org/publications/research-department-working-paper/2014/measuring-unfamiliar-economic-concepts-the-case-of-prepaid-card-adoption.aspx. Return to text

13. See Alice Cope, Alexandra Rock and Maximilian D. Schmeiser (2013) Risk Perception, Risk Tolerance and Consumer Adoption of Mobile Banking Services https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2048565. Return to text

14. New York City Department of Consumer Affairs (2015) New York City Mobile Services Study: Research Brief https://www1.nyc.gov/assets/dca/MobileServicesStudy/Research-Brief.pdf. Return to text

15. In focus groups conducted by the FDIC with unbanked and underbanked consumers, using mobile phones for account management (e.g., checking balances or recent transactions) was the most popular mobile financial service. Even those who did not use mobile financial services thought this would be one of the most beneficial aspects of using these services. See FDIC (2016) Opportunities For Mobile Financial Services To Engage Underserved Consumers: Qualitative Research Findings, https://www.fdic.gov/consumers/community/mobile/mfs_qualitative_research_report.pdf. Return to text

16. In focus groups conducted by the FDIC, several underbanked consumers indicated they would prefer to have a bank employee set up mobile banking for them to make sure it was done correctly. This was particularly true for those who were not already using mobile banking. In addition, many of those who had begun using mobile banking started with a basic task like checking account balances, and as their confidence and comfort grew, engaged in other tasks like transferring funds. Return to text

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.