Bank economists expect credit conditions to weaken over the next six months, according to the American Bankers Association’s latest Credit Conditions Index released today.

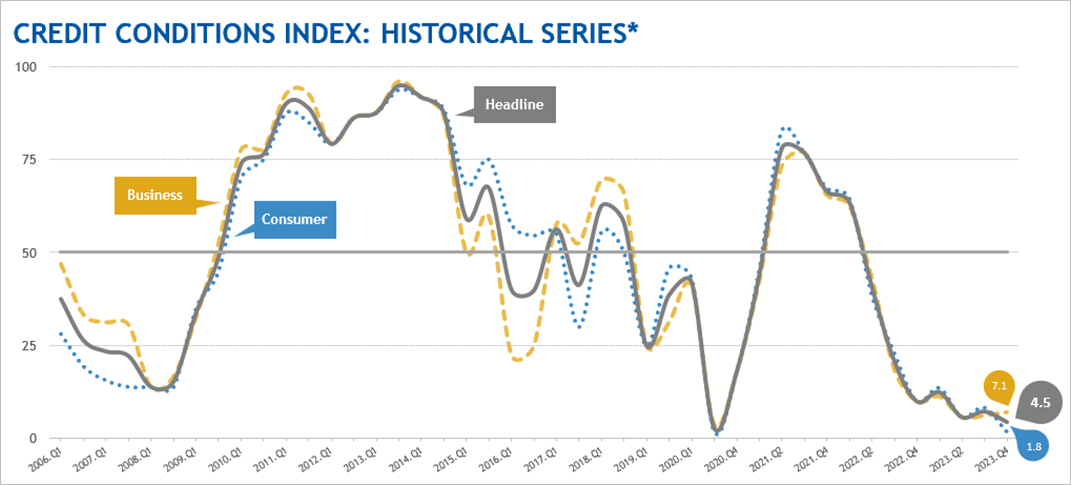

The latest summary of ABA’s Credit Conditions Index examines a suite of indices derived from the quarterly outlook for credit markets produced by ABA’s Economic Advisory Committee (EAC). The EAC includes chief economists from North America’s largest banks. Readings above 50 indicate that, on net, bank economists expect business and household credit conditions to improve, while readings below 50 indicate an expected deterioration.

According to the Q4 2023 report, most EAC economists believe that both credit quality and credit availability will weaken over the next six months for both consumers and businesses:

- Among households, consumer spending has been the driving force behind the U.S. economy but is likely to slow later this year and next year as wage growth cools, pandemic-era savings dwindle and student loan repayments restart. Households have increasingly turned to credit cards to support spending, and credit card delinquency rates are now similar to pre-pandemic levels (but well below levels from the 1990s and 2000s).

- Among businesses, commercial and industrial lending has fallen for most of 2023, reflecting a “risk-off” posture among many business owners. EAC forecasts reflect this sentiment, as business investment is expected to grow at just a 1% annualized rate over the next year. Still, financial stress remains relatively low, and resilient consumer demand has boosted business cash flow.

For the fourth quarter release:

- The Headline Credit Index fell 2.8 points in Q4 to 4.5, reflecting a consensus among bank economists that credit market conditions will continue to weaken over the next two quarters. As a result, banks are expected to continue to exercise caution when extending credit to both businesses and consumers over the remainder of the year.

- The Consumer Credit Index worsened 6.5 points to 1.8 in Q4. All EAC members expect consumer credit quality to regress toward historic norms in the next six months, and nearly all members expect credit availability to fall as well. Overall, the sub-50 reading indicates that credit conditions for consumers are likely to weaken over the next two quarters.

- The Business Credit Index improved marginally, by 0.9 points in Q4 to 7.1. As a group, most EAC members expect both business credit availability and quality to worsen, though some members anticipate little change in both quality and availability. Overall, the sub-50 reading indicates that credit conditions for businesses are likely to weaken over the next two quarters.

“Top bank economists serving on our Economic Advisory Committee are forecasting weak growth in household spending and business investment over the next four quarters before a modest pickup in the second half of next year,” said ABA Chief Economist Sayee Srinivasan. “Accordingly, ABA’s latest Credit Conditions Index indicates that banks will continue to exercise greater caution in lending decisions until at least the end of the year.”

Read the full report with detailed charts and a discussion of the broader economic context.

About the Credit Conditions Index

The ABA Credit Conditions Index is a suite of proprietary diffusion indices derived by the American Bankers Association from surveys of bank chief economists from major North American banking institutions. Since 2002, the bank economists have forecasted credit quality and availability for both businesses and consumers, indicating whether they expect conditions to improve, hold steady, or deteriorate over the ensuing six months. Readings above (below) 50 indicate that, on net, these expert business analysts expect credit market conditions to improve (deteriorate). Input from the bank economists is equally weighted in the indices. This data will remain anonymous, but historical index values are available upon request.

Answers to Frequently Asked Questions about the ABA Credit Conditions Index can be found in an Appendix attached to the outlook. This report and all previous reports can be found at https://www.aba.com/news-research/research-analysis/aba-credit-conditions-index.